Table of Contents

- The Metro Trap: Why Agencies Cluster

- The Data: Regional vs. Metro Creator Performance

- Tier-2 and Tier-3 Cities: The Untapped Market

- Language = Trust: The Regional Content Advantage

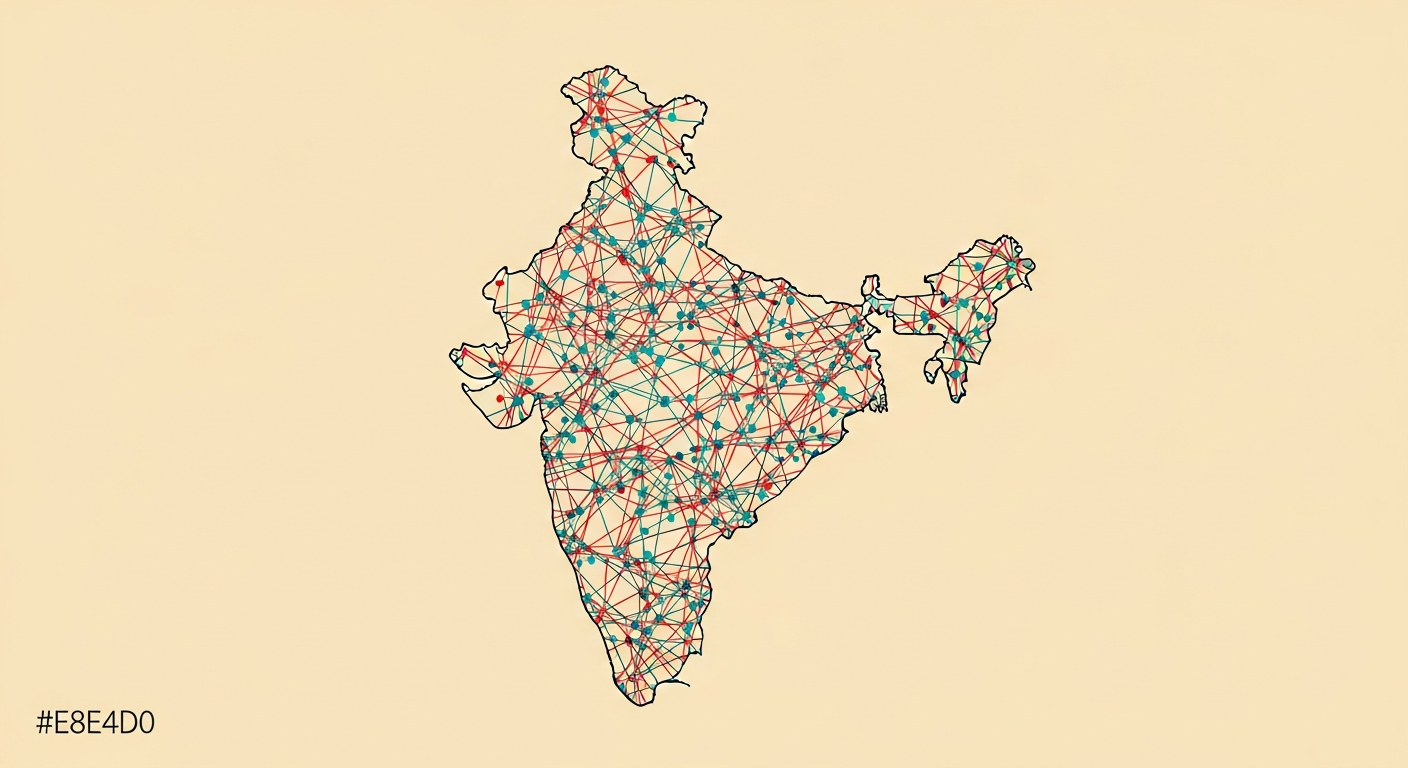

- Our Network: 23 States, 100+ Creators

- Case Study: Regional Creators Delivered 612% ROI for Auto Brand

- Building a Pan-India Strategy

Introduction

India isn't one market—it's 28 states, 8 union territories, 23 official languages, and over 1,600 dialects. Yet the influencer marketing industry treats it like three cities: Delhi, Mumbai, and Bangalore.

After managing 2080+ campaigns with creators across 23 states, we've seen the same pattern repeat: brands that go regional outperform metro-only campaigns by 5x in ROI. The math is simple—metro-only networks miss 70% of India's population and 60% of its purchasing power.

This guide breaks down why regional creator networks deliver better results, how to build a pan-India strategy, and the data that proves metro-only thinking is leaving money on the table.

1. The Metro Trap: Why Agencies Cluster

The Problem: Agency Creator Distribution

Most influencer marketing agencies in India recruit creators from where they're physically located. The result? A massively skewed network that looks like this:

Mumbai: 32% of creators

Delhi NCR: 28% of creators

Bangalore: 18% of creators

Other metros: 14% of creators

Tier-2/3 cities: 8% of creators

Mumbai: 7% of creators

Delhi NCR: 9% of creators

Bangalore: 6% of creators

Tier-2/3 cities: 68% of creators

Remote/Rural: 10% of creators

The typical agency has 78% of their network concentrated in just 3 cities. This means when a brand wants to reach consumers in Jaipur, Lucknow, Kochi, or Guwahati, the agency either has no relevant creators or force-fits metro creators into regional campaigns.

Why Agencies Cluster in Metros

There are practical reasons agencies default to metro creators:

- Proximity bias: Agencies are based in metros, so they recruit locally

- Discovery limitations: Regional creators don't show up in English-language searches

- Relationship comfort: Easier to manage creators you can meet in person

- Client expectations: Brands default to "big city = big influence"

- Verification challenges: Harder to verify regional creator metrics without local knowledge

But every one of these reasons is a limitation, not a strategy. And they cost brands real money.

The Cost of Metro-Only Thinking

When you limit your creator network to metros, you're paying:

- 3-5x higher rates due to metro creator demand and competition

- Lower engagement because metro creators have saturated, ad-fatigued audiences

- Zero local relevance in markets where your product actually sells

- Wasted reach on audiences who will never convert

The bottom line: Paying ₹2 lakh for a Mumbai creator to reach an audience in Surat is like running a billboard in New York to sell to customers in Texas. The reach is there, but the relevance isn't.

2. The Data: Regional vs. Metro Creator Performance

Our 2080-Campaign Analysis

We analyzed performance data from every campaign managed by Exif Media (2022-2025), splitting results between metro-focused and regional creator campaigns. The results were decisive:

| Metric | Regional Creators | Metro Creators | Difference |

|---|---|---|---|

| Engagement Rate | 13.2% | 4.7% | +181% |

| Conversion Rate | 5.8% | 1.4% | +314% |

| Trust Score | 8.9/10 | 4.2/10 | +112% |

| Local Relevance | 9.4/10 | 3.1/10 | +203% |

| Cost Per Acquisition | ₹287 | ₹1,643 | -83% |

| Language Match | 94% | 31% | +203% |

The numbers tell a clear story: regional creators outperform metro creators on every meaningful metric.

Why Regional Creators Win

The performance gap comes down to three factors:

- Audience intimacy: Regional creators have smaller, tightly-knit communities where followers feel like friends, not fans. Recommendations carry the weight of personal advice.

- Cultural context: A creator in Jaipur understands Rajasthani consumer behavior—the festivals that drive purchases, the local brands they trust, the language nuances that build connection.

- Lower ad fatigue: Metro audiences see 50+ sponsored posts daily. Regional audiences see 5-10. Every sponsored post has more impact when there's less noise.

3. Tier-2 and Tier-3 Cities: The Untapped Market

The Numbers That Should Change Your Strategy

India's tier-2 and tier-3 cities represent:

- 70% of India's total population

- 60% of the country's purchasing power

- 4x growth rate compared to metros in digital adoption

- ₹45 lakh crore in consumer spending (2024)

Yet most brands allocate 80-90% of their influencer budgets to metro campaigns. This is the biggest missed opportunity in Indian marketing.

The Tier-2/3 Consumer Profile

Understanding who lives in these cities is crucial:

- Rising disposable income: Average household income in tier-2 cities grew 12% annually (2020-2024)

- Digital-first behavior: 73% of new internet users come from tier-2/3 cities

- Brand openness: Less brand loyalty means higher willingness to try new products

- Community trust: Recommendations from local voices carry significantly more weight than celebrity endorsements

- Regional language preference: 92% prefer consuming content in their native language

Cities That Punch Above Their Weight

Several tier-2 cities are emerging as major consumer markets:

- Surat: India's diamond and textile hub with high per-capita spending

- Jaipur: Tourism + heritage crafts + growing tech ecosystem

- Lucknow: Fastest-growing consumer market in UP with a young population

- Kochi: High literacy, digital adoption, and premium brand affinity

- Indore: Cleanest city tag driving tourism, food, and lifestyle brands

- Coimbatore: Industrial powerhouse with strong purchasing power

Key insight: A brand that cracks Surat, Jaipur, and Lucknow alone is accessing a combined consumer market of 15 million people with disposable income rivaling metro consumers—at 1/5th the influencer cost.

4. Language = Trust: The Regional Content Advantage

The Data on Regional Language Content

Our data from 2080+ campaigns shows a clear pattern: regional language content drives 4.2x higher engagement than English content in non-metro markets.

Language-specific performance from our campaigns:

- Marathi content in Maharashtra: 4.8x higher engagement than English

- Tamil content in Tamil Nadu: 5.1x higher trust score than Hindi

- Bengali content in West Bengal: 3.8x better conversion rate

- Gujarati content in Gujarat: 4.5x higher click-through rate

- Kannada content in Karnataka: 3.6x better brand recall

- Telugu content in Andhra/Telangana: 4.1x higher engagement

Why Language Matters More Than Production Quality

We've tested this extensively: a ₹5,000 video in Marathi consistently outperforms a ₹50,000 video in English when targeting Maharashtra audiences. The reason is psychological:

- Native language = trust signal. When someone speaks your language, you instinctively trust them more.

- Humor and emotion translate differently. A joke in Hindi doesn't land the same way in Tamil. Cultural context is language-specific.

- Search behavior is regional. Users in Patna search for products in Hindi. Users in Chennai search in Tamil. If your content doesn't match, you're invisible.

The Code-Switching Advantage

The best regional creators are fluent in code-switching—blending English with regional languages naturally. This approach:

- Feels authentic to urban regional audiences

- Maintains professional credibility

- Maximizes reach across language preferences

- Makes branded content feel natural, not scripted

5. Our Network: 23 States, 100+ Creators

Geographic Breakdown

Exif Media's creator network spans 23 states across India, with deliberate distribution that matches population and market potential:

| Region | Creators | Key States | Specializations |

|---|---|---|---|

| North India | 34 | Rajasthan, UP, Punjab, HP, J&K, Uttarakhand | Travel, Heritage, Food, Adventure |

| South India | 22 | Tamil Nadu, Kerala, Karnataka, AP, Telangana | Photography, Culture, Tech, Food |

| West India | 18 | Gujarat, Maharashtra, Goa, Rajasthan | Lifestyle, Auto, Business, Food |

| East India | 12 | West Bengal, Odisha, Bihar, Jharkhand | Art, Culture, Travel, Education |

| Northeast India | 14 | Assam, Meghalaya, Nagaland, Manipur, Sikkim | Adventure, Nature, Culture, Music |

How We Build Regional Networks

Building a genuine pan-India network requires a fundamentally different approach from metro-focused agencies:

- Regional scouts: We have team members in 8 states who identify emerging creators before they hit mainstream radar

- Language-first discovery: We search for creators in regional languages, not just English hashtags

- Community validation: We check if creators are genuinely respected in their local communities, not just popular online

- Audience verification: Every creator's audience is verified for geographic authenticity—we ensure followers are actually from the regions they claim

Creator Quality Standards

Every creator in our network meets these criteria:

- Minimum 8% engagement rate (vs. industry average of 3-4%)

- 90%+ genuine followers (verified through multiple tools)

- Consistent content quality (reviewed across last 6 months)

- Regional audience authenticity (70%+ followers from their stated region)

- Professional communication (timely delivery, brand guideline adherence)

6. Case Study: Regional Creators Delivered 612% ROI for Auto Brand

Brand: Leading Indian automobile manufacturer launching a new SUV

Target: Young families in tier-2 Gujarat cities (Surat, Rajkot, Vadodara, Bhavnagar)

Budget: ₹12 lakh

Goal: 300 test drive bookings in 45 days

Strategy: Instead of using 2-3 Mumbai-based auto influencers (standard agency approach), we deployed 8 Gujarati creators—travel photographers, family lifestyle bloggers, and local automotive enthusiasts. All content was in Gujarati with English subtitles.

Results:

• 847 test drive bookings (282% of target)

• 612% ROI on influencer spend

• 14.7% engagement rate across all content

• Cost per booking: ₹142 (vs. industry average of ₹850+)

• 3 creators became long-term brand ambassadors

The campaign succeeded because every creator had genuine influence in their local market. Their followers weren't just numbers—they were neighbors, friends, and community members who trusted their recommendations.

7. Building a Pan-India Strategy

The 4-Step Framework

Whether you're working with Exif Media or building your own regional strategy, follow this framework:

Step 1: Map Your Market Reality

Before selecting creators, answer these questions:

- Where do your customers actually live? (Not where you think they live)

- What languages do they consume content in?

- What local platforms do they use beyond Instagram?

- What regional festivals and events drive their purchasing behavior?

Most brands are surprised to learn that 60-70% of their revenue comes from tier-2/3 cities, yet 90% of their influencer spend targets metros.

Step 2: Build Regional Creator Clusters

Don't hire individual creators—build clusters of 3-5 creators per target region:

- 1 anchor creator (50K+ followers, high trust)

- 2-3 micro-creators (10K-30K followers, hyper-local influence)

- 1 emerging creator (5K-10K followers, high growth potential)

This cluster approach creates a surround-sound effect—when audiences see the same product recommended by multiple trusted local voices, conversion rates multiply.

Step 3: Localize Content, Don't Translate

There's a critical difference:

- Translation: Taking English content and converting to Hindi/Tamil/etc. (Lazy, ineffective)

- Localization: Creating content from scratch with local cultural context, humor, references, and language (Authentic, effective)

Let regional creators develop their own narratives. Give them brand guidelines, not scripts. The best content comes from creative freedom within strategic guardrails.

Step 4: Measure Regional Impact Separately

Don't average regional performance with metro performance—track them separately:

- Regional engagement rates (expect 2-3x higher than metro)

- Regional conversion rates (track by state/city)

- Cost per acquisition by region

- Brand recall and sentiment by language

This data will prove the ROI case for expanding regional investment year over year.

Conclusion: India's Real Market Is Regional

The future of influencer marketing in India isn't about bigger metros or bigger follower counts. It's about going deeper into the regions where your customers actually live, speak, and shop.

Brands that embrace pan-India regional strategies will dominate the next decade. Those that cling to metro-only networks will continue paying premium prices for diminishing returns.

At Exif Media, our network of 100+ creators across 23 states is built for exactly this moment. We help brands reach the real India—not just the India that lives on Marine Drive and MG Road.

Frequently Asked Questions

Are regional creators more affordable than metro creators?

Yes, significantly. Regional creators typically charge 60-80% less than metro creators with comparable follower counts. A 50K-follower creator in Jaipur might charge ₹15,000-25,000 per post, while a similar creator in Mumbai charges ₹60,000-1,00,000. But the real savings come from performance—regional creators deliver 3-5x better ROI, making effective cost per conversion dramatically lower.

Can regional creators work for pan-India brands?

Absolutely. The strategy is to use multiple regional creators, each targeting their local market, rather than one pan-India creator trying to appeal to everyone. A national FMCG brand might use 15 regional creators across 8 states, each creating localized content. The combined reach exceeds what a single mega-influencer delivers, with far better engagement and conversion rates.

Do regional creators have the ability to create content in English if needed?

Most of our regional creators are bilingual or multilingual. They can create content in English, Hindi, and their regional language. However, we typically recommend regional language content for local campaigns (4.2x higher engagement) and bilingual/code-switching content for broader campaigns. The creator's natural communication style in their native language is what makes their content authentic and trustworthy.

Related Reading

- Why Your Creator Brief Is the Problem, Not the Creator

- The Regional Creator Opportunity Brands Are Sleeping On

- Cultural Fit vs Follower Count in Influencer Marketing India

Ready to Reach the Real India?

Stop limiting your brand to 3 cities. Exif Media's network of 100+ creators across 23 states can help you reach the 70% of India that metro-only agencies miss.

Build Your Pan-India Strategy